WHY BUSINESS TRADELINE ARE IMPORTANT?

Business tradelines are important for building business credit. Business tradelines can be used to increase a company's credit score, which is essential when seeking loans and lines of credit from lenders or suppliers. With good business tradelines, businesses have access to more financing options with better terms, allowing them to expand their operations and grow their businesses. Additionally, having strong business credit can make it easier to get approved for other forms of financing such as government grants or business investments. Furthermore, good business tradelines can help businesses gain credibility in the eyes of both customers and vendors, as a higher credit score indicates that a company is financially responsible. All these factors contribute to the overall success of an organization, making business tradelines an indispensable tool for any enterprise.

EXPERIAN BUSINESS CREDIT

Experian Business Credit allows companies to access their business credit score and monitor their tradelines in order to maintain a good standing with lenders. With Experian, businesses can view the details of each tradeline and identify any negative items that may be affecting their credit score. With this information, businesses can take the necessary steps to improve their credit rating and access more favorable financing terms. Additionally, Experian provides helpful tips and advice on how best to manage business tradelines in order to maximize success. By utilizing Experian’s services, businesses have the ability to stay ahead of changing market conditions and ensure that they remain competitive in today's economy.

SBFE BUSINESS CREDIT

Small business financial health is critical to the economic growth and stability of a country. SBFE Business Credit helps banks assess the financial health of small businesses more accurately, so they can make more informed decisions regarding lending or extending credit lines. By providing access to objective and reliable data, SBFE Business Credit enables banks to better understand both existing and potential customers, helping them reduce risk and increase profits.

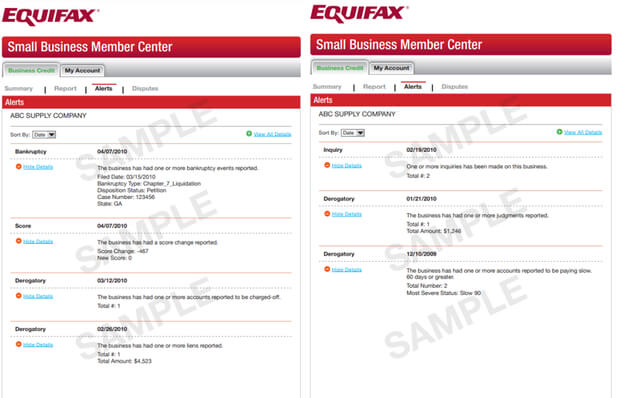

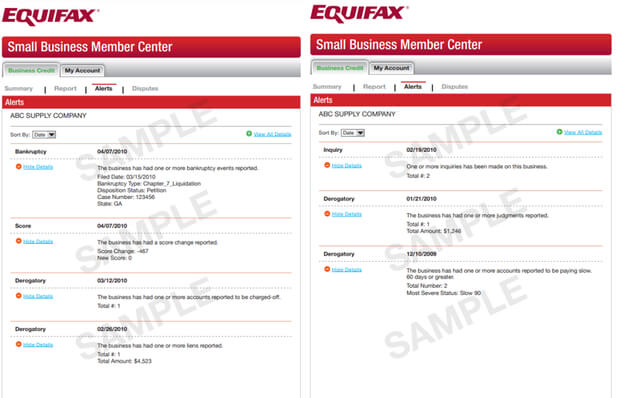

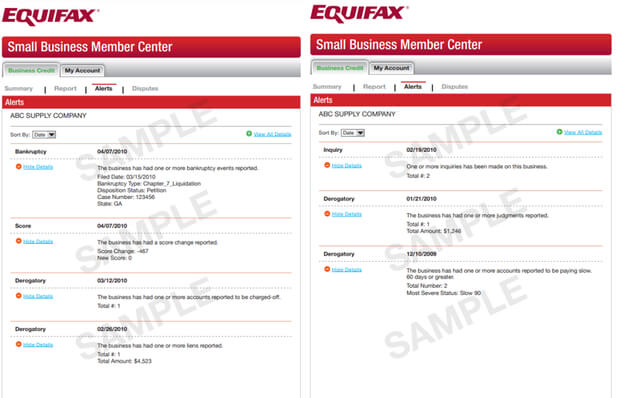

EQUIFAX BUSSINESS CREDIT

Many major banks such as Bank of America, JPMorgan Chase & Co., U.S. Bank, and Wells Fargo use Equifax Business Credit in their loan decision-making process. Other smaller regional banks also use Equifax Business Credit reports to assess the creditworthiness of small business owners. It is important for small business owners to be aware of how their business credit affects their ability to access financing from these institutions, and understand which ones may be looking at their Equifax data when assessing their eligibility for loans or lines of credit.

BUSINESS TRADELINE PRICING

PACKAGE

EXPERIAN & SBFE $4500

- EXP $50K NON AGED

- EXP $100K AGED

- SBFE $50K NON AGED

- SBFE $50K AGED

- SBFE $75K AGED

EXPERIAN NON AGED

& SBFE

- 50K $1499

- 100K $2499

- 150K $3499

EXPERIAN AGED

& SBFE

- 50K $1899

- 100K $2799

- 150K $3799

SBFE

AGED

- 50K $799

- 75K $999

EQUIFAX

& SBFE

- 15K-20K $799